We've partnered with America's most trusted insurance carriers

Need to speak to an expert?

Life Insurance in minutes

Protecting futures, one family at a time.

Benefits are paid free of federal income tax.

Once approved, life insurance benefits are never canceled or reduced for the life of the policy as long as premiums are paid on time.

A great supplement for existing life insurance or insurance provided by your employer.

No-risk money-back guarantee.

The same coverage is also available for your spouse or other family members.

Get coverage in 3 easy steps:

Get a quote

Get a personalized life insurance quote online by answering a few simple questions and instantly view estimated costs for different policy options.

Apply in minutes

Our secure online application is quick and easy, taking just around 5 minutes to complete.

Get coverage

After submitting your application, we’ll process it swiftly—often instantly—and inform you of your coverage eligibility and rates. If approved, you can activate your coverage right away.

What others are saying

"I feel relieved knowing my family doesn't have to worry about certain expenses"

"After being declined for life insurance multiple times due to my health history, I thought I’d never be able to secure coverage. Keevia made it so easy and found a guaranteed issue policy. There was no medical exam or lengthy approval process—I had coverage in place within days!

- Susan W - 72

"Now we have peace of mind knowing that our loved ones will be taken care of no matter what."

"We needed coverage that would take care of both immediate expenses and long-term financial security for our children. Keevia’s team was amazing—patient, knowledgeable, and genuinely cared about getting us the best plan."

- Amanda & John R. - Parents of two

Frequently Asked Questions

But I have insurance through my employer, isn’t that enough?

Employer-sponsored policies usually provide coverage equal to 1-2 times your annual salary, which falls short of the recommended amount. Financial experts suggest having life insurance coverage around 10 times your annual income. This is why many choose to purchase individual policies to bridge the gap and ensure adequate protection.

What does life insurance cover?

Life insurance can help cover major expenses such as a home mortgage, debts, and your children’s college tuition, as well as replace lost income. It can also be used to manage everyday costs—essentially, anything your beneficiaries need. Ultimately, the decision on how to use the payout is entirely up to them.

How much insurance do I need?

One simple way to estimate your coverage needs is to multiply your annual income by 10. Alternatively, you can total your long-term financial obligations and subtract your assets—the remaining amount is the gap life insurance should cover.

Can I speak with a live person?

Absolutely! What sets keevia apart is our commitment to personalized service—you can speak with a live agent anytime during normal business hours. You can also conveniently schedule a time to speak with us at Schedule A Call With A Live Agent

Who is eligible to apply?

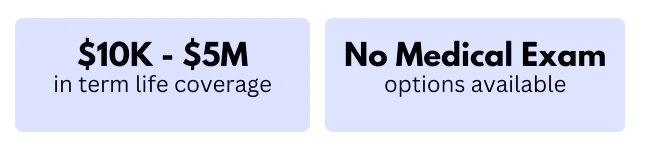

All U.S. citizens and permanent residents ages of 20-85 can apply for coverage with Keevia. If you’re 65 and under, you can own term coverage until age 80. If you are over 65, a guaranteed issue whole life insurance policy might be an easy way for you to get coverage quickly. keevia is licensed and operates in 49 U.S. states.

What insurance options does keevia offer?

We offer a wide range of life insurance options, including term life, whole life, universal life, and final expense coverage for all ages between 20-85, with guaranteed issue options available. Our term life insurance is available for ages 20-65, offering 10 to 30-year terms with coverage amounts ranging from $20,000 to $8 million, depending on eligibility. Additionally, we provide guaranteed issue whole life insurance for ages 65-85, ensuring coverage even if you have pre-existing health conditions.

Does keevia offer a money back guarantee?

Yes. Our application is 100% free and won’t affect your credit score. Additionally, each policy has a 30-day free look period with a money-back guarantee. So if you aren't satisfied, you are eligible for a full refund if you cancel within the first 30 days after purchase. After the first 30 days, you may cancel your policy whenever you want to, for any reason. There are no cancellation fees or penalties if you choose to cancel your policy. You can cancel your policy by calling or emailing us, and requesting a surrender form for you to sign electronically. We will cancel your policy upon receipt, and there's never any cancellation fees.

2024© Keevia Insurance, LLC (DBA Keevia, Keevia Agency) ("Keevia"), a Florida corporation with its principal place of business in Tampa, Florida, is a licensed independent insurance agency in 49 States. Any insurance policy premium quotes or ranges displayed are non-binding. The final insurance policy premium for any policy is determined by the underwriting insurance company following application. Keevia offers policies issued by the carriers listed at www.keeviaagency.com/carriers. Products and their features may not be available in all states. To help avoid requiring a medical exam, our application asks certain health and lifestyle questions.